Your Options For Getting Out of Debt

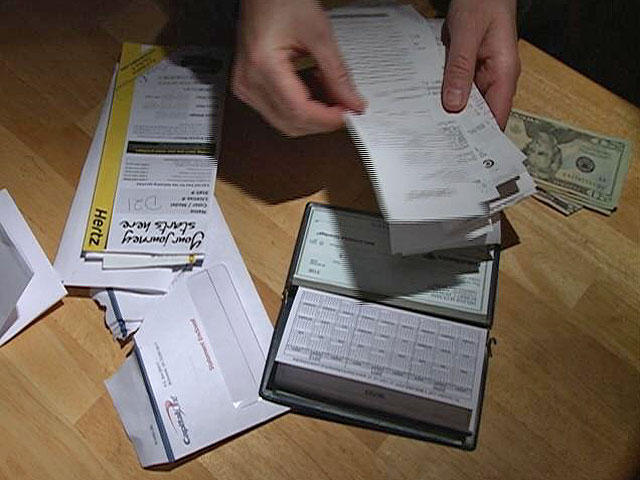

People have lots of alternatives at their disposal to help them get out of debt. Each option has its benefits as well as negative aspects. To locate the best program developed to aid you to leave debt, you need to find out about all the help that is offered to you. The different programs listed here will hopefully provide some sort of assurance. Not every one of these options will help in every situation. That is why a person’s economic state is examined extremely closely by experts prior to acceptance or approval. Several of the manner ins which most individuals remove the worry of extreme economic tension include:

Insolvency: This is a choice selected by individuals who owe large amounts of debts that they can not settle as well as legitimately declare a failure to make payments. In many cases, they may be obligated to pay later on in the future. Filing for insolvency can aid nevertheless it is usually a really complicated, lengthy procedure. Many individuals try to avoid this route if in all feasible due to the fact that it can harm a person’s credit report.

Budget/Credit Therapy: This program is designed to assist individuals in permanently removing debt. Right here, individuals pay arrangements over a certain time period. You can click here to investigate how the budget plans or debt counselors will normally calculate the overall quantity of money owed as well as use that complete to create a reasonable monthly budget. This spending plan usually includes the settlement of debts over a certain amount of time, such as 3 or five years. This system of settlement has actually aided lots of people. However, some may require additional aid, such as aid from a debt negotiator.

Debt Settlement: This is a system of removing month-to-month repayments as well as minimizing the amount of passion or principal amount owed. Usually, this sort of program includes the help of a professional debt arbitrator. It involves preparing a reasonable payment strategy set by both the creditor as well as debtor. Furthermore, it was designed to be equally beneficial to both parties. Below, individuals will experience comfort by addressing economic responsibility.

Debt Combination: This process entails securing new lending to incorporate multiple debts. This is commonly provided for numerous factors. To start, individuals may want to refinance to be able to safeguard lower rates of interest. The benefit of just being required to create one regular monthly check rather than a number might appeal to them. The quantity they repay every month is generally much more affordable, which is among the main reasons individuals pick this.

Another factor for settling is to aid protect against proclaiming personal bankruptcy. Even with this, borrowers are still required to very carefully consider the choice to settle. It is a practically permanent choice. In the unfortunate event, somebody requires to declare bankruptcy, combining financial obligations can be destructive alleviation.

People might not even be granted the privileges that bankruptcy can pay for if he or they initially combine all financial obligations. Additionally, combinations might end up costing much more ultimately. This is because decreasing month-to-month payments cause a boost in the variety of months or years it takes for lending to be repaid, causing needing to pay even more passion.